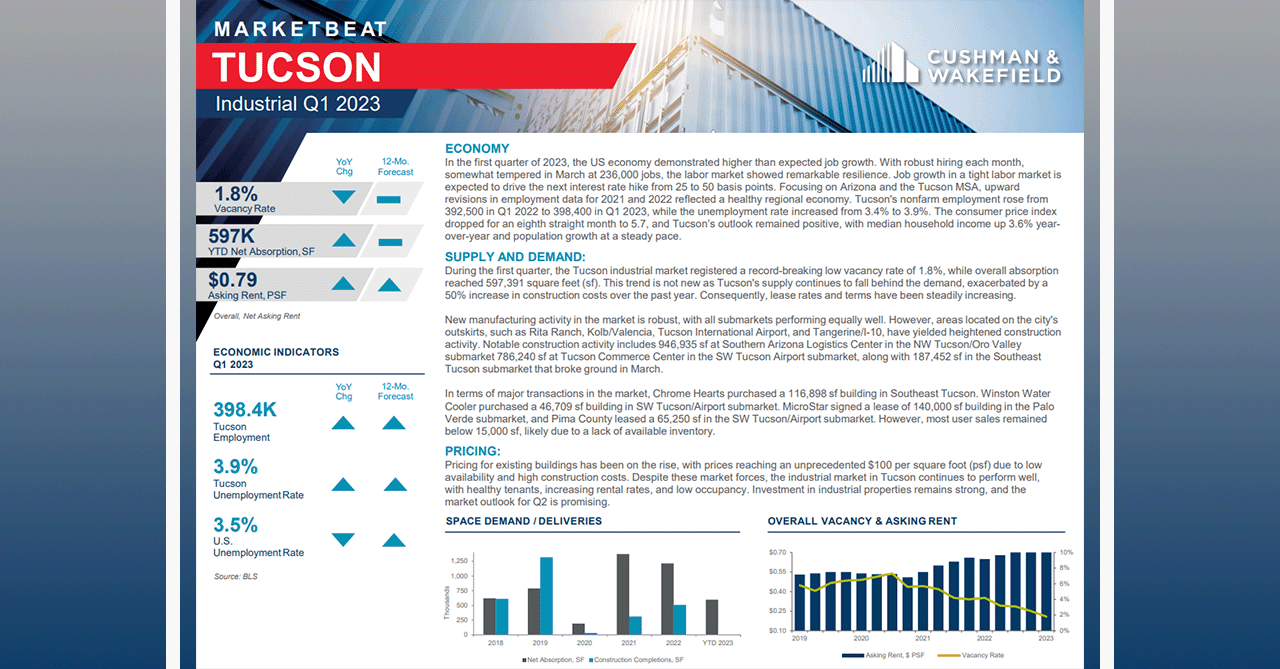

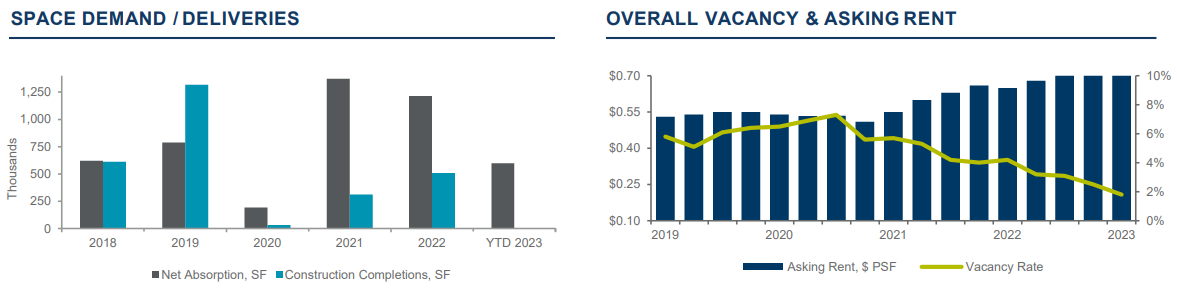

During the first quarter, the Tucson industrial market registered a record-breaking low vacancy rate of 1.8%, while overall absorption reached 597,391 square feet (sf). This trend is not new as Tucson’s supply continues to fall behind the demand, exacerbated by a 50% increase in construction costs over the past year. Consequently, lease rates and terms have been steadily increasing.

To read the full report on Tucson’s industrial activity in Q1, click here.

New manufacturing activity in the market is robust, with all submarkets performing equally well. However, areas located on the city’s outskirts, such as Rita Ranch, Kolb/Valencia, Tucson International Airport, and Tangerine/I-10, have yielded heightened construction activity. Notable construction activity includes 946,935 sf at Southern Arizona Logistics Center in the NW Tucson/Oro Valley submarket 786,240 sf at Tucson Commerce Center in the SW Tucson Airport submarket, along with 187,452 sf in the Southeast Tucson submarket that broke ground in March.

In terms of major transactions in the market, Chrome Hearts purchased a 116,898 sf building in Southeast Tucson. Winston Water Cooler purchased a 46,709 sf building in SW Tucson/Airport submarket. MicroStar signed a lease of 140,000 sf building in the Palo Verde submarket, and Pima County leased a 65,250 sf in the SW Tucson/Airport submarket. However, most user sales remained below 15,000 sf, likely due to a lack of available inventory.

Pricing for existing buildings has been on the rise, with prices reaching an unprecedented $100 per square foot (psf) due to low availability and high construction costs. Despite these market forces, the industrial market in Tucson continues to perform well, with healthy tenants, increasing rental rates, and low occupancy. Investment in industrial properties remains strong, and the market outlook for Q2 is promising.