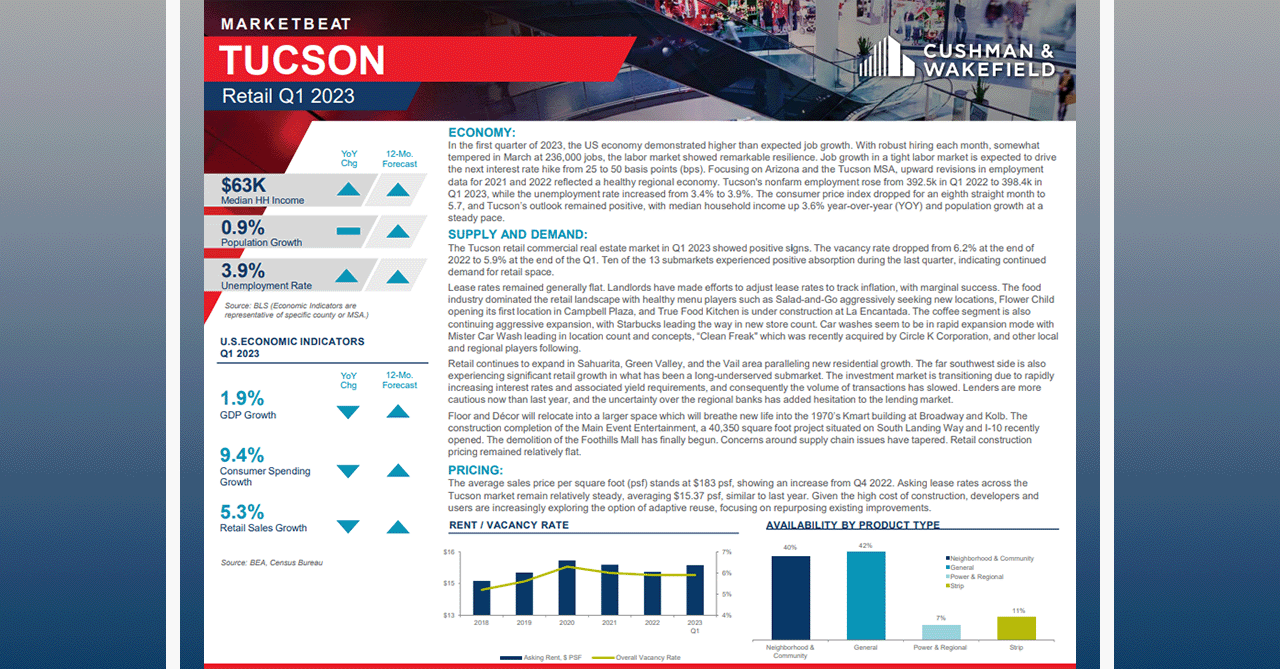

The Tucson retail commercial real estate market in Q1 2023 showed positive signs. The vacancy rate dropped from 6.2% at the end of 2022 to 5.9% at the end of Q1. Ten of the 13 submarkets experienced positive absorption during the last quarter, indicating continued demand for retail space.

To read the full report on Tucson’s retail activity in Q1, click here.

Lease rates remained generally flat. Landlords have made efforts to adjust lease rates to track inflation, with marginal success. The food industry dominated the retail landscape with healthy menu players such as Salad-and-Go aggressively seeking new locations, Flower Child opening its first location in Campbell Plaza, and True Food Kitchen is under construction at La Encantada. The coffee segment is also continuing aggressive expansion, with Starbucks leading the way in new store count. Car washes seem to be in rapid expansion mode with Mister Car Wash leading in location count and concepts, “Clean Freak” which was recently acquired by Circle K Corporation, and other local and regional players following.

Retail continues to expand in Sahuarita, Green Valley, and the Vail area paralleling new residential growth. The far southwest side is also experiencing significant retail growth in what has been a long-underserved submarket. The investment market is transitioning due to rapidly increasing interest rates and associated yield requirements, and consequently, the volume of transactions has slowed. Lenders are more cautious now than last year, and the uncertainty over the regional banks has added hesitation to the lending market.

Floor and Décor will relocate into a larger space which will breathe new life into the 1970s Kmart building at Broadway and Kolb. The construction completion of the Main Event Entertainment, a 40,350 square foot project situated on South Landing Way and I-10 recently opened. The demolition of the Foothills Mall has finally begun. Concerns around supply chain issues have tapered. Retail construction pricing remained relatively flat.

The average sales price per square foot (psf) stands at $183 psf, showing an increase from Q4 2022. Asking lease rates across the Tucson market remains relatively steady, averaging $15.37 psf, similar to last year. Given the high cost of construction, developers and users are increasingly exploring the option of adaptive reuse, focusing on repurposing existing improvements.