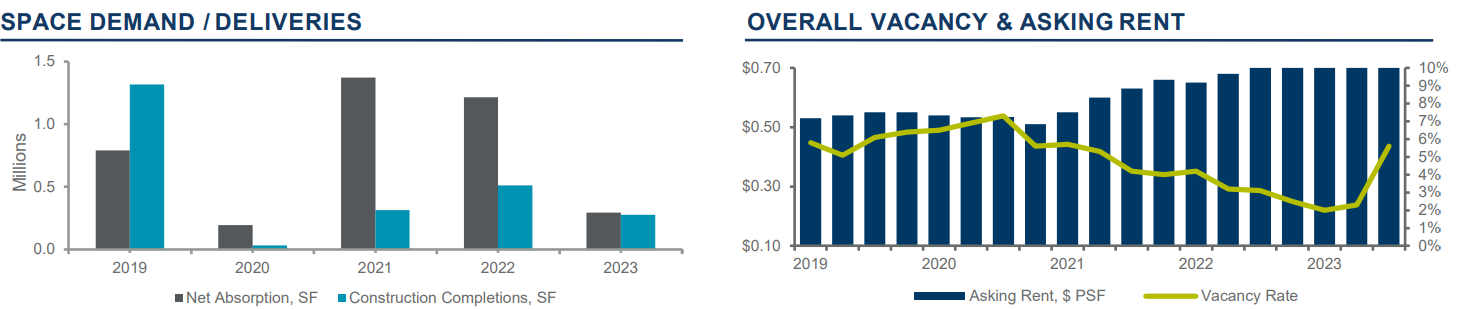

In the third quarter, the Tucson industrial market maintained a consistent demand-supply dynamic, marked by limited inventory. After experiencing vacancy below 4.0% in the second quarter of 2023, the vacancy rate rose to 5.6% due to delivery of new vacant product to the market. Despite this, there was a positive net absorption of 292,707 square feet (SF).

To read the full report on Tucson’s industrial activity in Q3, click here.

Rental rates were seeing continued upward pressure and ended at $0.80 per square foot (psf) per month. The manufacturing sector, particularly in autonomous technologies, robotics, batteries, electric vehicles, and mining, continued to surge. Warehouse distribution remained in demand throughout the prominent submarkets. The persistent demand for e-commerce and logistics in Tucson was attributable to the city’s positive net in-migration, the demand for quick delivery times on online orders, and the growing market share for online retailing. Sale volume is on pace for its lowest annual total since 2013 due to low inventory of available property with a lack of interest on the part of potential sellers.

Notable ongoing construction projects included the Flint distribution centers. The shells of the Southern Arizona Logistics Center spanning 946,935 sf in NW Tucson/Oro Valley, and two of the three buildings at the Tucson Commerce Center with 786,240 sf in the SW Tucson submarket are complete. The final building is expected to deliver in the fourth quarter of 2023. Additionally, the Campbell Landing project was slated for construction, comprising four 10,000 sf industrial buildings set to commence in the fourth quarter of this year. These new deliveries are the source of nearly all increased vacancy, as opposed to tenants downsizing or vacating existing facilities.

Tucson’s industrial market saw rising lease rates due to supply constraints and market volatility, which caused uncertainty in new construction. Despite the price increases, Tucson remained competitive and positioned for growth when interest rates and construction costs stabilize. With industrial rents at $0.80 psf month, it remained an affordable location to operate. The area’s strategic proximity to key trade entry points drove tenant demand, resulting in a 5.0% rent increase in the past year. Industrial asset sales moderated due to higher debt costs and economic uncertainties, with stable sales prices psf for a third consecutive year.