To read the full report on Tucson’s retail activity in Q1, click here.

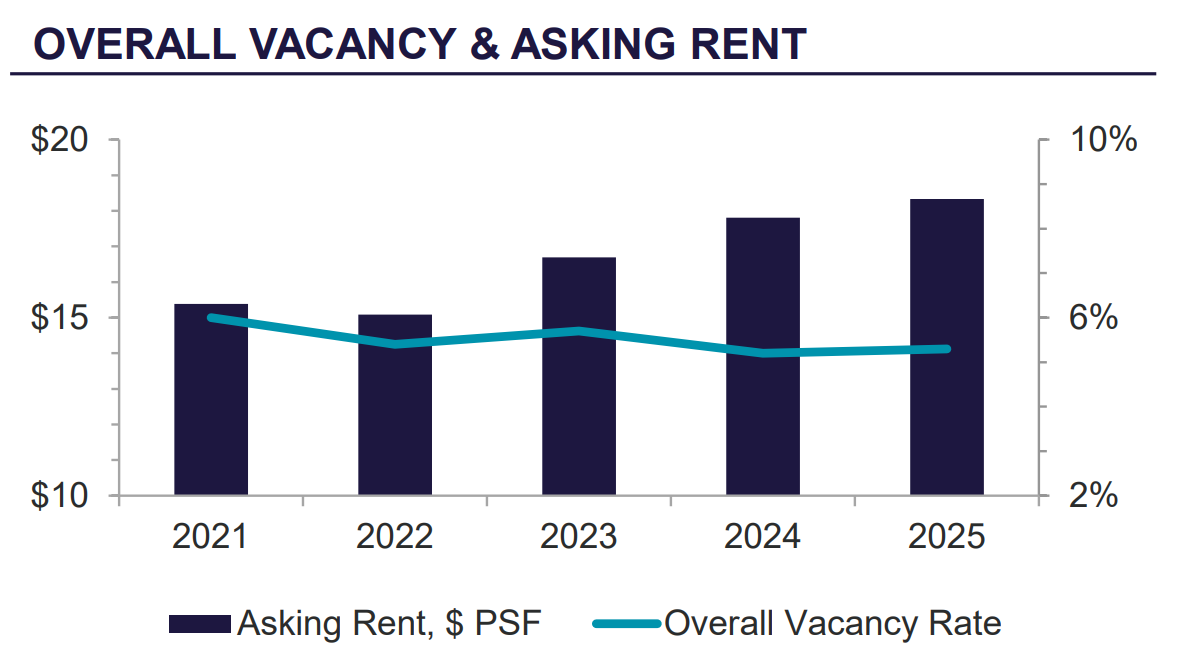

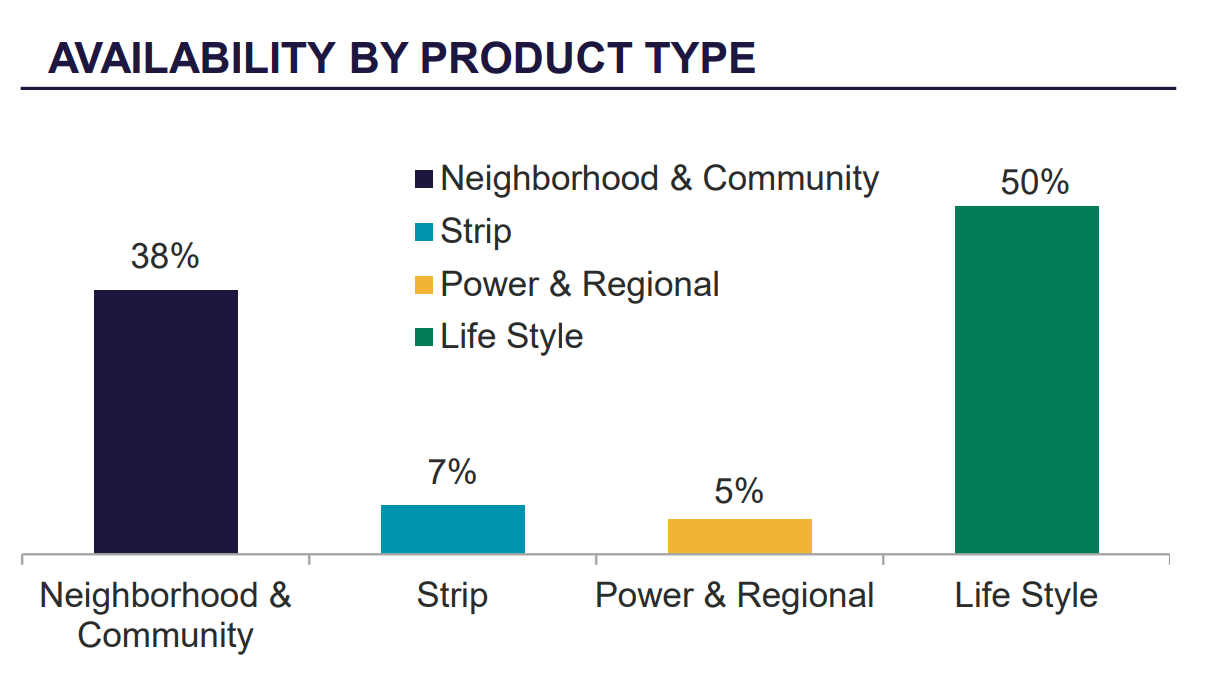

Tucson’s retail sector shows stability, maintaining a 5.3% vacancy rate. National consumer spending grew 3.0% in Q1 2025, with the food, beverage, and entertainment sectors remaining strong. Lease rates continue to rise for premium properties and new developments, alongside modest increases in tenant improvement allowances due to construction costs. Restaurants, auto-related businesses, and car washes favor pad site locations. Junior box spaces are being absorbed by retail, thrift, and recreational tenants while pharmacies continue to consolidate. High-demand submarkets include areas near malls, Oro Valley, growth corridors, and along I-10.

Key lease transactions demonstrate the strength of the thrift/resale segment. Just Between Friends leased 33,630 sf on Oracle, and Savers leased 33,355 sf on Broadway. Cavender’s, a Western wear retailer, backfilled a Walgreens at 4220 N. Oracle Rd, while Mister Car Wash is expanding at 4646 N Oracle Rd. Recent construction completions include a 5,000 sf Black Rock Coffee Bar at 2402 N 1st Ave and a 1,396 sf Take 5 Oil Change at 1983 W River Rd.

Projects currently underway include 100,974 sf at 1500 E Tucson Marketplace Blvd for Bass Pro Shops, a 59,417 sf pickleball facility at Oro Valley Marketplace, a 25,000 sf (medical) building at NEC of Cortaro and I-10, and 16,183 sf, which will include Cold Beers & Cheeseburgers (approx. 6,000 sf) at Broadway at Park Place. With high construction costs, the redevelopment of older sites along major streets is becoming increasingly attractive.

The average lease rate is $18.28 per sf, with Oro Valley commanding the highest rate at $26.23 sf, followed by downtown Tucson at $21.11 per sf. Investment sales are marked by considerable supply but slower transaction activity, resulting in stable cap rates. Prices for user buildings are slightly up but generally flat. Significant sales include Alturas Montesa Plaza, LLC purchasing 75,643 sf at 50-190 S Houghton Rd for $13 million, Winterhaven Investors, LLC (Brandon Rodgers, Torch Properties) purchasing 35,300 sf at 3102-3160 E Fort Lowell Rd for $5.3 million, and Mister Car Wash purchasing 23,550 sf at 4646 N Oracle Rd for $3.2 million for redevelopment.